Retirement Planning can be fun and stress-free with a Safely Structured Retirement Planning Strategy™ / SSRPS™

You may need a Retirement Vacation Planner!

You, or you and your spouse, could in fact have so much retirement income with which to enjoy retirement...that you may not be able to stop smiling.

Learn how to turn your retirement savings, your IRA, ROTH IRA, (your 401(K), your 403(b)/ TSA, Defined Benefit Plan), or other "after-tax savings" into a modern "Personal Pension”, or a "Personal Pension Plus" where you have the potential to realize higher interest rates for the rest of your life, with 100% Downside Protection Against Negative Market Returns.

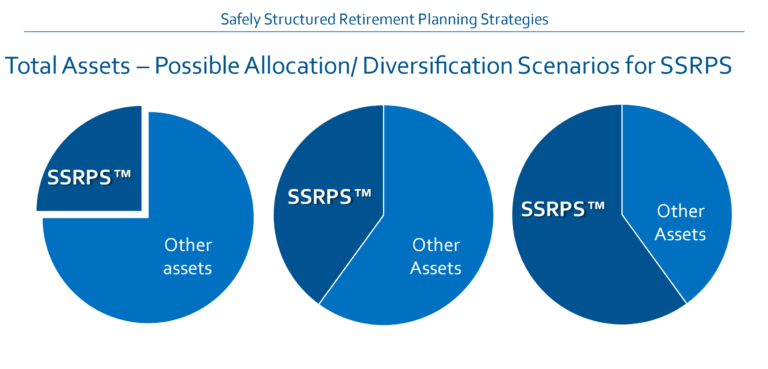

Learn how you have the opportunity to protect 100% of your savings/investments/your net worth by allocating /dedicating only a portion of available assets (example 25%, 33%, 50%) to a SSRPS™

Consider that retirees are often nervous about retirement, and fearful of market corrections, often hoarding their assets, afraid to ever spend money...

When you have a SSRPS™, we don't think you should be nervous about retirement, we don't think you should be fearful, in fact we think you should be joyful, as "you genuinely have the opportunity to spend all of your money in a stress-free manner", many times over, which leads to Happier Healthier Retirements.

I want you to appreciate the idea that everyone's retirement is really all about income, and what they can spend every day/month/year, and therefore... people need to appreciate "The Real Value of an Income Stream", that you will or you will not receive, depending on where it is you decide to invest or save your money.

I want you to learn how you can "Protect your retirement income from market volatility...", and live happily ever after!

I want you to "Appreciate how timing matters...I want you to appreciate how the sequence of your returns" can impact your life. I want to help you make good decisions. I don't want you to make retirement planning mistakes that you may not ever be able to recover from...

Let me give you a hypothetical educational example, where a husband and wife are both age 60, and they have $500,000 in a particular Retirement Account. Let's say that they want to retire in 5 years, and their goal is to have a financially secure retirement. Let's take a look at a Safely Structured Retirement Planning Strategy™ , where we use a "SSRPS™ Annuity", as a solution, where they could have contractually guaranteed income with the potential to increase over time, with the potential to keep up with and even far outpace inflation.

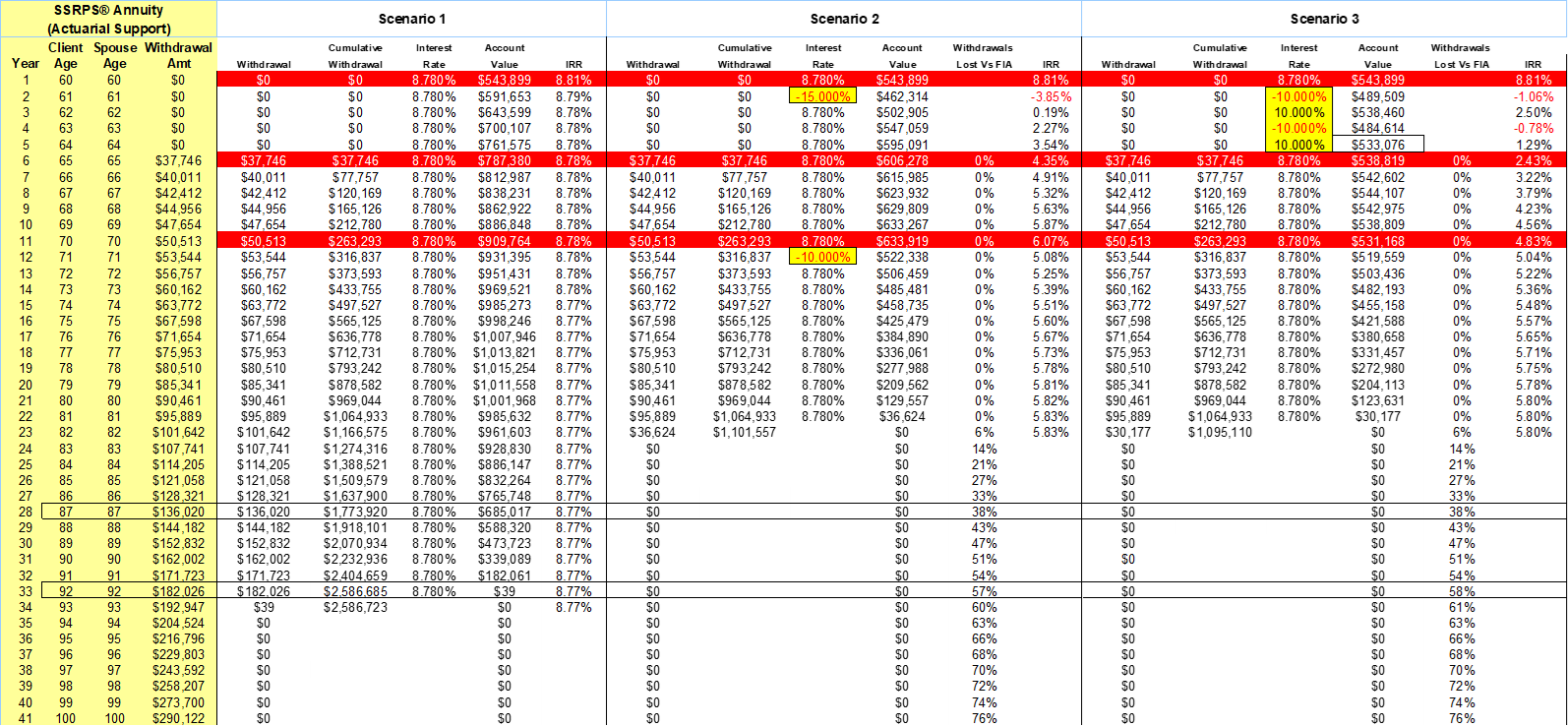

In the Yellow shaded Column to the left with the heading SSRPS™ Annuity, you see that the hypothetical income beginning in year 6 and continuing to age 100. This income is based on modest/realistic interest credits derived from putting your money into a, "indexing account" or "fixed account". Then you see "Scenarios 1, 2, and 3" to the right, where the "Real Value of the Income Stream" is measured to age 92. In Scenario 1 the value of the income stream is calculated to be a compound 8.78%.

This "Real Value of an Income Stream™, 8.78% in this example, is intended to provide perspective...intended to provide helpful retirement planning information. The "Real Value of an Income Stream™" idea, begs the question:

What net interest rate or return would be required by an alternative financial product/asset/investment, to match the hypothetical income stream produced by the SSRPS™ Annuity measured through age 92?

By the way, the actuaries say that there is a 50% chance that a 65 year old couple today will have one person living to age 92, and that is why we measure the value of an income stream to age 92.

Real Value of an Income Stream Measured to age 92

The "Real Value of an Income Stream™" in "Scenario 1" is again calculated to be a compound 8.77% (for 33 years in a row). Think about that for a minute..."Scenario 1" is demonstrating that a person with $500,000 in some hypothetical "Retirement Account" would have to earn a compounded 8.77% every year from age 60 to age 92 in order to match the income stream projected from the SSRPS™ Annuity.

You may have never considered how difficult it is to earn 8.78% for 33 years in a row, but financial professionals will tell you that it is virtually impossible because the stock market as you know goes up and down. Now consider how difficult it would in fact be, to earn 8.78% for 33 years in a row when you are taking withdrawals in retirement... When a person withdraws money from their retirement accounts to live on, when they spend that money, that money is no longer in their retirement account to grow back, when the stock market recovers.

The "Real Value of an Income Stream" idea begs 3 other related questions. Question #1: How much can your sequence of returns affect how long your money lasts?

Question #2: What will you really earn on your money in the end, if/when you experience stock marketing volatility, and you were to try and match the increasing income stream from a SSRPS™ Annuity?

Question #3: How much less income might you receive if/when you experience stock market volatility, and you tried to match the increasing income stream from a

SSRPS™ Annuity?

Let me answer all 3 of those questions by addressing the 2 other Hypothetical Retirement Accounts, "Scenarios 2 and 3".

In "Scenario 2" we show a different hypothetical situation, where we attempt to match the income stream from the SSRPS™ Annuity, demonstrating what would happen if a person earned 8.78% in all years, except for losing -15% in year 2, and then losing -10% in year 12.

Question: How would things turn out in "Scenario 2"? In "Scenario 2", if a couple was trying to match the withdrawals of the SSRPS™ Annuity, they would end up earning 5.83% in the end, and they would end up running out of money in year 22, being able to withdraw only $1,101,557. So just those two losses caused a person to a) earn substantially less, just 5.83% versus our SSRPS™ Annuity, where "the real value of the income stream" is 8.78%, and those two losses would cause a person to b) end up withdrawing 57% less income, as they were only able to withdraw $1,101,557, (and they would end up running out of money), versus the $2,586,723 in income that the SSRPS™ Annuity is projected to provide through age 92. Also, even though we only show income to age 100 in this example, know that the SSRPS™ Annuity would contractually continue to deliver the opportunity for increasing income for as long as a person or their spouse lives, even if they live to be 110 years old.

Question: How would things turn out in "Scenario 3"? In "Scenario 3" we show an attempt to again match the income stream from the SSRPS™ Annuity, where this time we show the effect of earning 8.78% in year 1, and then we show what happens if someone where to go up and down 10% in years 2 through 5 (losing -10% in year 2, then earning a positive 10%in year 3, then losing -10% again in year 4, then earning a positive 10% in year 5. Then we show that the person/couple is earning 8.78% from there on out...for as long as the money lasts.

In "Scenario 3" they would end up earning only 5.80%, and they would run out of money in year 23, being able to withdraw only $1,095,110. So, just going up and down 10%, experiencing just those two losses, would cause a person to a) earn substantially less than our SSRPS™ Annuity; 8.78% versus 5.80%. And just those two losses, again, caused a person to end up withdrawing 58% less income than the $2,586,723 in income that the SSRPS™ Annuity is projected to withdraw through age 92.

In our hypothetical/educational example, using our SSRPS™ Software, we are trying to deliver experiential learning. Our intent is to demonstrate how such volatility/sequence of return, can affect a hypothetical retirement account's ability to match the "Stress -Free Retirement Income Stream of a SSRPS™ Annuity". It is better you learn about a SSPRS™ now versus later so you don't find yourself saying at some point in the future "we should have considered a Safely Structured Retirement Planning Strategy™, we should have considered a SSPRS™ Annuity.

SSRPS™/Safely Structured Retirement Planning Strategies™ provides a clear-eyed view of the Real Value of an Income Stream from a SSPRS™ Annuity. People never analyze "the realities of sequence of return risk" relative to retirement planning and the distribution phase of life. Safely Structured Retirement Planning Strategies™ demonstrates 1) the opportunity a person has utilizing a SSPRS™ and associated financial products along with 2) the risks they bare if they rely solely on traditional wealth management/market sensitive investments alone.

SSRPS™ brings to the forefront like never before, the risk people take on unknowingly...as SSRPS™ transparently shows people how Longevity is a flat-out risk multiplier. As time goes on, as you live in to your 70s, 80s, 90s, the impact of inflation is magnified, the impact of market volatility is magnified, and the impact of a potential medical crisis/long-term care is magnified.

Are you in the Retirement Red Zone™? You've worked long and hard saving for retirement. And now, whether you're recently retired or thinking about retirement, you need a reliable strategy for turning your savings into income that can last a lifetime, keep up with inflation, and perhaps provide "coverage via enhanced/greater income" to pay for medical care; assisted living/home health care/long-term care. The Insurance Industry calls this period "The Retirement Red Zone®, a critical time when careful planning and prudent action is essential. Relative to the Retirement Red Zone™ you can see the red lines in our "Real Value of the Income Stream" ledger/picture.

I tell financial professionals, that if your client dedicates enough of their savings/investments to a SSPRS™, you and they can eliminate the fear of running out of money, you can eliminate/mitigate the fear of being able to keep up with inflation, you can eliminate/mitigate the fear of ever having to spend down your assets to pay for medical care if someone does have a medical crisis and they need assisted living or long-term care in the future. You can also eliminate the fear of ever leaving a surviving spouse financially vulnerable, which can happen if a couple spends a substantial portion of their retirement savings/investments to pay for the medical care of one spouse near the end of life, where "the surviving spouse may be left with very little in terms of savings/investments/money", with which to live the rest of their life which may last two or more decades.

Advisors tell me, as do their clients, that the SSPRS™ software, is necessary to fully understand how a Safely Structured Retirement Planning Strategy™ can work, or how a SSPRS™ Annuity can work. Advisors who are familiar with SSPRS™ will tell you that sometimes it is nearly impossible for the average person to look at an insurance company's illustration on their own and fully understand what they are looking at...Additionally, it is nearly impossible for the average person to look at an insurance company's illustration and imagine how that annuity fits into their overall retirement planning picture.

"It 100% needs to be explained by an expert, and the SSPRS™ software enhances a person's ability to understand what the financial professional/expert is telling someone, or what they are recommending a persons consider."

D.S.

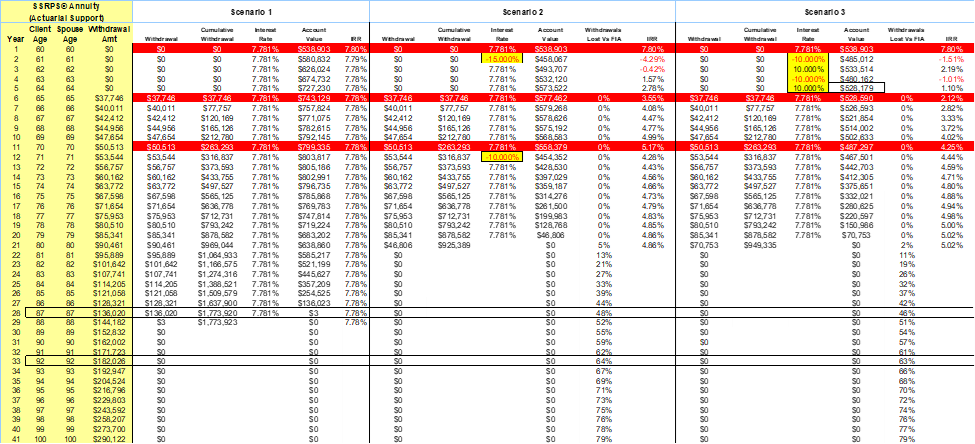

Just in case you are wondering what the "Real Value of an Income Stream Measured to age 87" would be in our hypothetical example, it's a compound 7.78% for 28 years in a row. See the picture below, where all of the same points can be made, as in the prior example, where we measured the Real Value of an Income Stream to age 92.

Real Value of an Income Stream measured to age 87

These are purely hypothetical, education examples, and each column is not an actual product or investment but rather a mathematical example of what could be considered "Simple Retirement Math", and the consequences of such losses/volatility. The point is, experiencing negative years early or too often can diminish the total value of your remaining assets. Over time, your withdrawals combined with such losses can chip away at your assets and cause your money to run out more quickly than anticipated. Hence we want you to consider using particular SSRPS™ annuity income streams that have the potential to deliver long-term financial security, via long-term financial efficiencies. A SSRPS™ Annuity can help you manage sequence-of-return risks for your retirement income, and we recommend a SSRPS™ Annuity as part of a diversified approach to retirement planning, aimed at providing a Stress-Free Successful retirement.

People know that the stock market goes up and down, that it can be volatile, and experienced financial professionals will tell you that they can "never tell you if or exactly when" the stock market will turn downward. Taking money out of retirement accounts that are exposed to a downward trend in the stock market can leave consumers vulnerable, and unfortunately, susceptible to sequence of return risk, which could cause a person to run out of money more quickly than perhaps they ever anticipated.

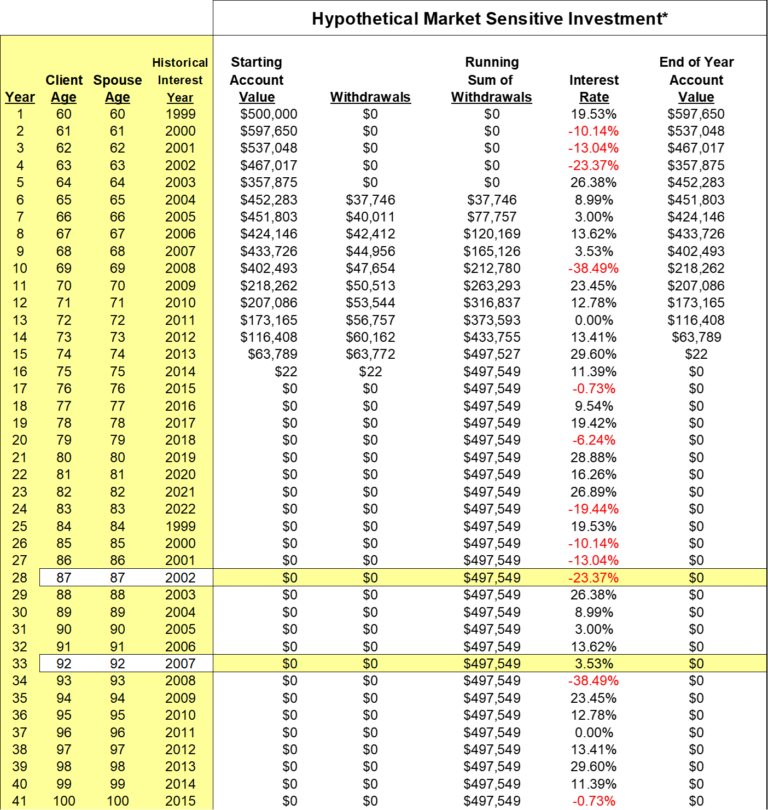

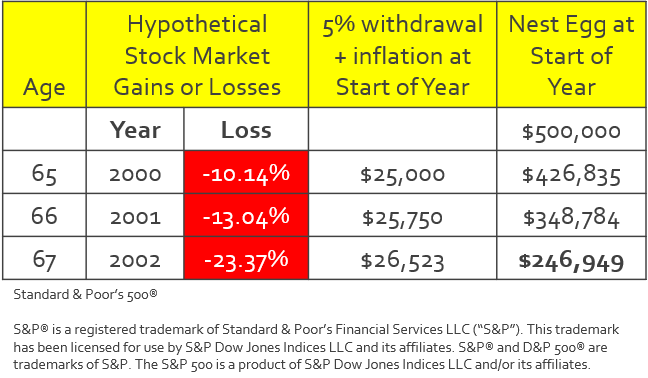

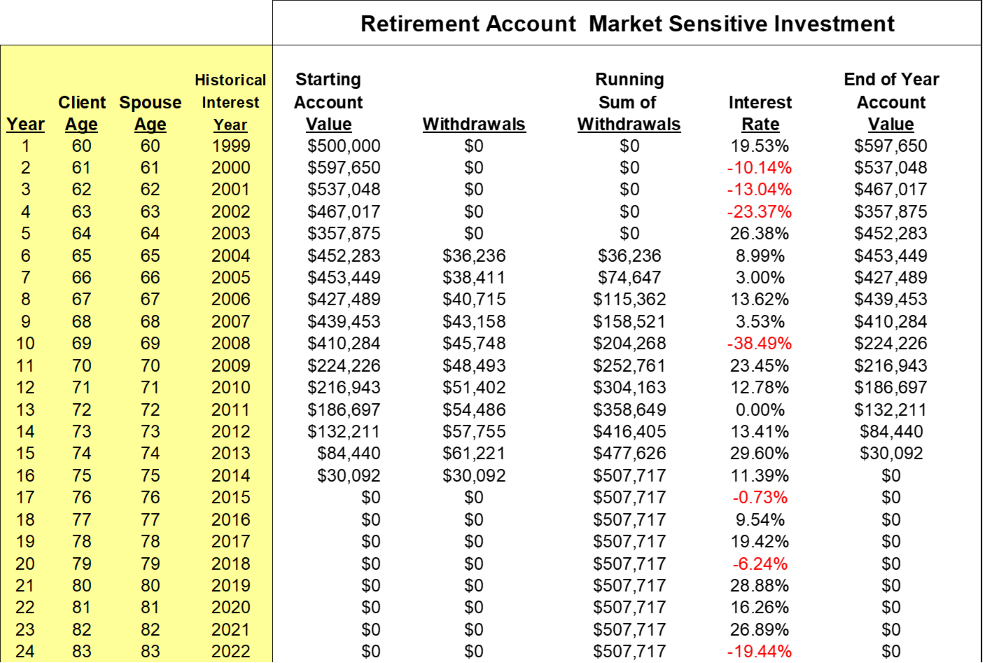

To demonstrate the point again, let's say someone age 65 had just retired in January 2000 following a 20 year Bull Market, and let's say they had $500,000 invested in the "stock market where they had returns similar to the S&P 500® Index". Let's say they wanted to withdraw 5% initially, and then increase their withdraw by 3% annually to keep up with inflation in the years 2000, 2001, 2002 the stock market went down -10.4%, -13.04%, and -23.37%.

Unfortunately, at the age of 67, this person would now have less than half the money they started with, which has to last them the rest of their lives...a retirement that may last 2 or more decades.

Consider that just last year (2022) the S&P® 500 stock market index went down 19.44% so if retirees withdrew 5%, their retirement account would be reduced by almost 25%, in just one year...

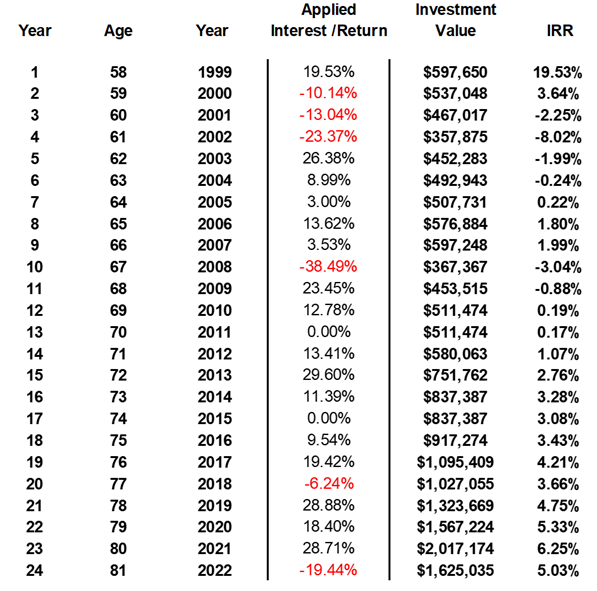

To demonstrate a different point, I ask the question "What if someone invested $500,000 in the stock market 24 years ago, in 1999, and received these market-like returns?" Look at how the "Interest Rate Realized/IRR" changes as market returns fluctuate...

In 1999 we see a great initial "Interest Rate Realized" of 19.53%...but in 2002 the "Interest Rate Realized" has dropped to -8.2%.., which equates to losing -8.02% a year for 4 years straight. Then you can see in 2020 the "Interest Rate Realized" is 3.66%... That's not a great "Realized Interest Rate" considering such risk.

Look at the stock market returns through 2022.

Consider such volatility, and the fact that today a couple age 65 has a 50% chance that one person will live to age 92...

Now, what would things look like if a couple age 60, who wanted to retire in 5 years, had $500,000 of retirement savings invested in the stock market, through the same period above, where they tried to take the same/matching withdrawals as those shown coming from our SSRPS™ annuity?

Again, these are purely hypothetical, educational examples, and each column is not an actual product or investment but rather a mathematical example of what could be considered "Simple Retirement Math", and the consequences of such losses/volatility.

Without a SSRPS™ many people could unfortunately run out of money, as "living longer is a risk multiplier" (inflation risk, volatility risk, medical crisis/cost risk).. With a SSRPS™ in place consider, the idea that you may have the financial protection/the guaranteed income stream required, that may allow a person to remain invested in the stock market and take market risk if they like, because if and when the market takes a downturn, a person can leave those market investments alone, perhaps giving such investments the time they may need to recover. What I am getting at is that you can do both, depending on your willingness to take on a stock market risk, meaning if you want to diversify and keep a portion of your money in market sensitive investments, it is recommended that you also have a good portion of your money dedicated to a SSRPS™ income stream that is guaranteed for the rest of your life, and guaranteed to increase over the years, as the slide below shows.

What I want people to understand is that the Stock Market goes up and down and when people tell you...or you hear "the stock market averages 7-10%", you need to understand that is not true...meaning "we do not live in a vacuum" you just can't say "the stock market averages 7-10%", what we all earn is based on "when we go into the stock market" or when we purchase a particular stock or mutual fund or ETF... and when we "get out" or "when we pull money out", as what we will earn depends on when we start and stop measuring our return. When a person is in retirement and is taking distributions/withdrawals understand that all it takes is just one or two down years as you saw in our "Real Value of an Income Stream" example and a person may never be able to recover; that is they may never be able to keep up with or match the SSRPS™ income stream/withdrawals.

We can prove to anyone that it is virtually impossible to earn 7% for extended periods of time let alone the rest of your life, especially if you consider withdrawals/distributions in retirement; withdrawals/distributions are the "fly in the ointment" so to speak.. And if you add other elements such as investment costs/fees into the mix, the "Retirement Math" gets worse.

If you have a SSRPS™ however, you will have the opportunity to contractually realize 5%, 6%, 7%, 8%, 9% + interest safely, measured through life expectancy, which I contend provides the long-term financial security most people are looking for, but just don't know they can have...Also, if you are married, when you have a SSRPS™, you can protect your spouse and vice versa, because when one spouse passes away, the surviving spouse will never have to worry about running out of money, as the guaranteed lifetime income that will increase over the years will continue to be paid to the surviving spouse. So it's a good idea, that when a couple is planning for retirement, that each person allocates a good portion of their 401(k)/IRA/retirement savings to a SSRPS™ joint income stream that is guaranteed for the rest of both their lives' because they would be protecting each other's long -term financial security.

Those who learn about SSRPS™ will come to realize that the value of a guaranteed SSRPS™ income stream that they cannot outlive, may in fact be invaluable.

Consider a potential medical crisis where a person may need Long-Term Care/Assisted Living/Alzheimer's Care...without a SSRPS™ many people will not have the resources/ability to handle such health care cost. We can show you how a SSRPS™ can help cover such costs and put your mind at ease.

If you have a SSRPS™ you will never run out of money.

A SSRPS™ could provide you with the retirement of your dreams...

Aspire to Retire with more Spendable Income in Retirement than you ever thought possible.

Learn how to be a Joyful Investor/Saver:

- 100% joyful financial security

- Anxiety-free inflation adjusted income

- Efficient income benefits to help cover Long-Term Care/Assisted Living/Alzheimer’s Care

- Optional Tax-Free Death Benefit

- Greater Legacy/inheritance opportunities for Loved Ones

What if you don't want or need income in retirement, but you want Market Protection and Growth Potential

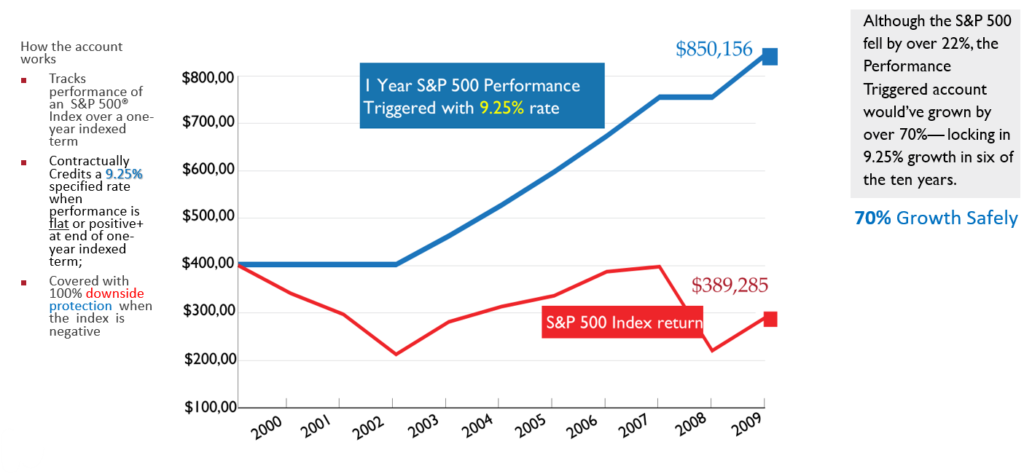

What if the “lost decade”…wasn’t lost?

It was the worst decade for stocks since the Great Depression.

Q: Could it happen again? Here’s a smart way to plan for it.

Fixed Indexed Annuities are growing more popular in the face of a) potential market volatility, b) general retirement planning, and c) longevity concerns, as longevity is a risk multiplier. If you are in your 50s, 60s, 70s, 80s… and you are, or you will be, taking withdrawals/ distributions in retirement, you simply cannot afford a market downturn. If you need growth and protection like most people, you may want to consider staying exposed to the market safely via a Fixed Indexed Annuity “linked” but not directly invested in the S&P 500®. We’ve picked one of the worst financial periods in history 2000 to 2010, known as “the lost decade” … to show the possibility of building long-term wealth safely, even in the toughest years.

You can have lock-in growth annually, even when stocks are “lost.”

The "lost decade" from January 2000 through December 2009 resulted in disappointing returns for many who were invested in securities, such as the S&P 500®. Let’s see how a $500,000 fixed indexed-linked annuity would perform in an annual S&P 500 Performance “Triggered” Account Option, with a 9.25% specified rate, let's see how it (blue line) would weather the storm known as “the lost decade”.

Key Features

SSRPS™ is a Modern Financial Planning Discipline, a fusion of investment and administrative efficiencies and actuarial pooling principals, attainable only at an institutional level, where consumers can benefit from a combination of contractual guarantees plus product performance.

Protected From Market Volatility

Increasing Retirement Income Stream for as long as you live

Protect Your Retirement Income/Money from a Long-Term Care/Medical Crisis

Protect 100% of your savings/investments, by allocating/dedicating only a portion of available assets (example 25% - 33%) to a SSRPS™

"Safely Leverage" Your Assets Contractually

Does What Wealth Management Alone Cannot

Not Dependent on Traditional Diversification

Spendable Income Advantage

FAQs

What is a SSRPS™… What is a Safely Structured Retirement Planning Strategy?

A Safely Structured Retirement Planning Strategy™/SSRPS™ can be considered a “Modern Financial Planning Discipline”, an approach used in retirement planning, and/ or estate planning, and/ or special needs planning.

In utilizing a SSRPS™, a consumer with the help of their financial professional, structures their assets (or a portion there of), using “insured/ guaranteed financial/ retirement products*”, a particular type of annuity, and/ or particular life insurance contracts, to protect and grow assets, and/or to protect and grow income streams.

When a person has a SSRPS™ their a) principal is protected, b) any gains/ interest earned is locked-in/ protected from future market/ index downturns and c) they never run out of money/ income in retirement. * In addition, a SSRPS™ will d) eliminate inflation risk, to the degree by which the consumer receives a contractually guaranteed increasing income stream*. In fact, the income stream generated from a SSRPS™ will potentially far outpace inflation. You will learn there are also benefits with respect to e) the ability of a SSRPS™ income stream to cover a substantial amount of any cost related to a future medical crisis, where an individual cannot perform 2 of 6 activities of daily living, or they have Alzheimer's, where an individual may need home health care, or private nursing, or assisted living, or long term care, and there is no medical underwriting with the annuity side of SSRPS™. A SSRPS™ can do even more than bringing financial health to a client's retirement planning strategy, as there are f) health and wellness benefits associated with having a stress-free retirement income stream. You will immediately become familiar with g) what we call a "Spendable Income Advantage" that a SSRPS™ has over other planning strategies, which utilize traditional investments alone or predominantly.

How much Money/Retirement Income can I get with SSRPS™?

A SSRPS™ can readily generate substantially more money than what you put into it, over time, meaning depending on your age, you could receive 2, 3, 4, 5, 10, 20 times more money than what you have in your retirement accounts, savings accounts, or investment accounts today. A SSRPS™ can serve as a Personal Pension ensuring that when you retire you will have income for the rest of your life regardless of what is going on in the economy or the stock market. With a SSRPS™ you have contractual protection of your principal (the money you put in), contractual protection of any growth/ credited interest, contractual protection of your guaranteed lifetime income that will increase over time. A SSRPS™ alone can accomplish all of this, because a SSRPS™ truly is a unique planning strategy. A SSRPS™ is again a Modern Financial Planning Discipline, a fusion of investment and administrative efficiencies and actuarial pooling principals, where consumers can benefit from a combination of contractual guarantees plus product performance.

Can You Provide a High Level but Simple View of SSRPS™ & Equivalent Wealth?

- You are either going to need to earn a rather steady/high compounded single digit rate of return/interest rate for THE REST OF YOUR LIFE or

- You are going to need to start off with a lot more money

- If a conservative person is happy earning 4% with a CD at the bank, so they would need to put $2,121,983 into that 4% CD, in order that they could begin at age 65 to pull out the same income stream as our SSRPS™; totaling $3,311,317 through age 87 and $4,828,478 through age 92 . This example required 121% more money to receive the same retirement income as our SSRPS™.

- A person who is willing to accept risk put’s his or her money into the stock market on January 1st 1996, where the 1st 4 years of returns represents an “Example of significant positive returns in the early years” relative to Sequence of Return Risk which were 20.26%, 31.01%, 26.67%, and 19.53%, and this person would need to put in $1,262,020, in order that they could begin at age 67 to pull out the same income stream as our SSRPS™, totaling $3,311,317 through age 87 and $4,828,478 through age 92. This example required $1,262,020, or 26% more money to receive the same retirement income as our SSRPS™.

- A person who is willing to accept risk put’s his or her money into the stock market on January 1st 1999, where the 1st 4 years of returns represents an “Example of significant negative returns in the early years” relative to Sequence of Return Risk which were 19.53%, -10.14%, -13.04%, and -23.37%, and this person would need to put in $2,405,224, in order that they could begin at age 67 to pull out the same income stream as our SSRPS™ totaling $3,311,317 through age 87 and $4,828,478 through age 92. This example required $2,405,224, or 140% more money to receive the same retirement income as our SSRPS™.

Is SSRPS™ like a pension?

Consider that a SSRPS™ is technically not a pension, but a SSRPS™ will contractually serve as a Personal Pension. And just as folks have referred to a pension as a “paycheck for life”, so too can a SSRPS™ provide you with a “paycheck for life”. In fact a SSRPS™ can ensure, or shall we say insure, that you will have guaranteed income that increases over time for the rest of your life regardless of what is going on in the economy or the stock market.

Is my principal and interest safe with a SSRPS™?

With a SSRPS™ your principal, plus any growth/interest, along with your guaranteed lifetime income are protected, and guaranteed against loss; you cannot lose a dime.

Will the income from a SSPRS™ Keep-up with inflation?

The SSRPS™ guaranteed lifetime income will increase over time based on a) only positive movements in a stock market index, and/ or b) based on a fixed interest rate, for example 4.5%.

How is it that the income from a SSRPS™ can be greater than the income derived from my investments in the stock market or the savings account or CD that I have at a bank?

A SSRPS™ alone can accomplish all of this, because a SSRPS™ is truly a unique planning strategy. A SSRPS™ is in fact a Modern Financial Planning Discipline, where there is a fusion of investment, administrative and actuarial efficiencies, where consumers benefit from a combination of contractual guarantees plus product performance, where a person or persons can receive contractually guaranteed increasing income for the rest of their life, regardless of how long they live. Traditional investing or saving "has no actuarial support", or "there is no pooling advantage" associated with traditional investing or saving, so in retirement, when you take distributions/withdrawals from your savings/investments, your income will continue only for as long as your assets last. Consider that when you are retired, any money you have invested in the stock market will be subject to the ups and downs of the stock market/economy, meaning sometimes the value of your assets will increase and sometimes it will decrease, and then you have to account for the distributions/withdrawals you are taking. The point is, experiencing negative years early or too often can diminish the total value of your remaining assets. Over time, your withdrawals combined with such losses can chip away at your assets and cause your money to run out more quickly than anticipated. Consider using a "

SSRPS®

annuity" with a Type #2 income stream as part of a strategy to help you manage sequence-of-returns risks for your retirement income.

What Is The Spendable Income Advantage of SSRPS™ All About?

When you have a SSRPS™, “you genuinely have the opportunity to spend all of your money in a stress-free manner”. There is this “Spending Phenomenon” relative to having a Safely Structured Retirement Planning Strategy™, in that a person with a SSRPS™ has the potential to literally spend all of their money many times over, resulting in a “Spendable Income Advantage”. It can be demonstrated that a person with a SSRPS™ can afford to spend their money in a more “carefree manner”, where they can immediately begin to enjoy their retirement, where they can immediately spend more of their money than typical traditional planning may allow, and they can spend that money without concern of ever running out of money, because they enjoy guaranteed lifetime increasing income potential, contractually. Thus, a person with a SSRPS™ can enjoy stress-free spending in retirement, more so perhaps than a person with a more traditional retirement planning strategy, where their ability to spend money in retirement will be more closely tied to their retirement account values which fluctuate with the ups and downs of the stock market.

Why do you say that there are health and wellness benefits associated with SSRPS™ that are not associated with traditional saving or investing?

What are the new/ various opportunities that a SSRPS™ provides, that people may not otherwise have?

The guaranteed increasing income opportunity provided from the SSRPS™ income stream gives people new planning opportunities. Consider that people with a SSRPS™ income stream gives people new planning opportunities. Consider that people with a SSRPS™ can put a legacy plan in place, they can leave money to the heirs, without it being a financial burden, in a manner that just isn't possible when people rely on traditional wealth management alone, stocks and bonds and mutual funds etc...

How can a SSRPS™ act as a portfolio protection plan, thus protecting a person’s overall savings and investment portfolio/ wealth?

When a person has a SSRPS™, there are benefits relative to a person's other assets. Consider that if a person has a SSRPS™, but a person also has for example 50%/60%/70% of their overall investible wealth invested elsewhere, be it in the stock market, real estate, or other ventures...if they have a SSRPS™, then if/when the stock market takes a deep downturn, i.e. 20%, 30%, 40%, or even 50%, a person with a SSRPS™ may be in a position to "leave those other assets alone", or "not take as much money from such accounts" after a loss, which may allow those assets/ accounts to recover when the market turns upward again.

Has SSRPS™ changed the nature of Retirement Planning and Financial Planning?

The world of financial planning/ retirement planning/ estate planning/ special needs planning, has forever changed, it’s just that people don’t know what they don’t know.

People can now structure their assets differently than they had in the past and receive long term financial security that simply was never available, prior to the development/design of a "Type #2 Income Stream". The type #2 Income Stream allows people to literally, safely leverage their assets/money/savings/investments, to not only secure their financial future, but to perhaps make their retirement and legacy dreams come true.

The SSRPS™ platform / software provides an experiential learning opportunity for people to discover new planning opportunities.

Hence, I call SSRPS™ “a Modern Financial Planning Discipline”, a fusion of investment/ administrative and actuarial efficiencies.

When is it to early to start a SSRPS™?

It is never to early or too late to start a SSRPS™, as a SSRPS™ can be put together for children where the owner is a guardian, and they can be put together for an 80 year old (maximum age).

What happens to my money if I pass only a few years after putting our money into a SSRPS™ product?

The money that you put into a SSRPS™ is always protected, your principal is always protected against loss (principal is the money you put in), the interest is protected (any fixed interest or market-linked interest you earn is locked-in and protected), and your income is protected as well, your retirement income is guaranteed for as long as you or you and your spouse live, even if you live to be around 120.

So if you the "owner pass away", your account value or an enhanced account value can go directly to your beneficiary/heirs, however, if you are married, via "spousal continuation" your spouse can keep the contract and a) continue to receive the income stream or b) they can take the account value or an enhanced account value as a death benefit.

The point is, your money is safe and will pass on to loved ones one way or another.

What are the spousal benefits with a SSRPS™?

Understand that when you have a SSRPS™ and a spouse passes, the surviving spouse is financially protected, as he or she will never run out of "lifetime income" that continues to increase over the years for as long as they live.

What would happen if you were still alive and ran out of money...Would you go back to work? Would you move in with children? Would you have to cancel your retirement plans/goals, etc?

With a SSRPS™ you can never run out of money/income because a SSRPS™ will serve as a "Modern Personal Pension Plus"...providing long-term financial security with guaranteed lifetime income, that increases over the years via only positive stock market indexing interest credits, or by a fixed interest rate credit, to help you keep up with or outpace inflation.

Do I have to invest all my money into a SSRPS™?

Every situation is different so the amount of money someone many dedicate to a SSRPS™ depends on their particular situation.

What is the cost associated with setting up my Safely Structured Retirement Planning Strategy?

The financial professional is compensated directly from the company relative to the products associated with a SSRPS™, so there are no costs or fees that you will ever pay to the financial professional relative to the products associated with a SSRPS™.

Will you outlive your savings and run out of money?

Well not if you have a SSRPS™.

"Why?" or "How can you say that?"

When you a have SSRPS™, it means that your retirement plan is contractually guaranteed, it is "Stock Market Crash Proof" and "Recession Proof" and "Inflation Proof" and to a degree, "Medical Crisis Cost Proof"

When you have a SSRPS™, you have a contractually guaranteed income stream that will increase over the years, an income stream that will come to you or you and your spouse, for as long as either one of your lives, an income stream that will help you keep up with or even outpace inflation, an income stream that can help you pay for medical care related to "Home Health Care" or "Long-Term Care" or "Assisted Living" or "Private Nursing" or "Alzheimer's Care"

How is living longer a Risk Multiple?

Consider the reality that "Longevity" or "Living Longer" is a "Risk Multiplier".

Consider the reality that "Longevity" or "Living Longer" is a "Risk Multiplier".

- Longevity is a risk multiplier because as we live longer, the more likely we are to experience the ill effects of inflation, where we lose purchasing power over time. So we really need a reliable retirement income stream that can grow larger and larger over the years, in order that we can keep up with or even outpace inflation.

- Longevity is a risk multiplier because as we live longer, the more likely we are to experience stock market volatility, a recession, or an outright stock market crash.

- Longevity is a risk multiplier because as we live longer, the more likely we are to experience a medical crisis where we may need "Home Health Care" or "Long-Term Care" or "Assisted Living" or "Private Nursing" or "Alzheimer's Care".-Most people are concerned about the potential cost of "Home Health Care" or "Long-Term Care" or "Assisted Living" or "Private Nursing" or "Alzheimer's Care"...yet most people have no plan to cover such costs...(or no financial capability, so they think...)

Can a SSRPS™ eliminate my fear and worries about money and being able to retire comfortably?

I believe a SSRPS™ can eliminate your fears and your worries about being able to retire comfortably.

A comfortable retirement is part of the American dream, and although studies indicate that many people spend hours worrying everyday of their life about retirement and money, believing that “a comfortable retirement may be hard to reach”, you might say “that’s only because they don't know about SSRPS™”.

I can show you that if a person dedicates enough of their savings / wealth to a SSRPS™, that they could have more money coming to them in retirement, based on both performance and contractual guarantees, than perhaps they ever dreamed possible.

If you look at your assets, and you make SSRPS™ part of your overall plan to have a diversified retirement planning strategy, you will have a retirement planning structure in place, a safe structure; you will in fact have a Safely Structured Retirement Planning Strategy™.

If you take enough of your retirement savings and you put that money into the appropriate SSRPS™ insured financial products, you will then receive a guaranteed increasing income stream in retirement that will come to you or to you and your spouse for the rest of your life, and then you shouldn’t be worrying about running out of money.

Your SSRPS™ case design will show you what you should reasonably expect to receive, based on both performance and contractual guarantees, and that should make you feel much better, much more comfortable when you retire. Although many Americans feel they are unprepared, people who have a personal SSRPS™ designed just for them may be pleasantly surprised at the income they could reasonably expect to receive.

The real driver of retirement savings flowing into the Modern Financial Planning approach we call SSRPS™, is the confidence, the peace of mind, the joy, the excitement one will feel when they set up their SSRPS™. With a SSRPS™… you really can have a happy and healthy retirement.

Consider that “Millennial Americans worry 1.9 hours a day - 13 hours a week - 28 full days a year”, and people “ages 45 and up worry about money every day on average 1.6 hours a day – 11 hours a week – 24 full days a year”*. I contend that all or much of that worrying could disappear the moment they saw their personal SSRPS™ case design.

*Taken from a Schroders 2023 US RETIREMENT SURVEY, Retirement readiness report.

How can a SSRPS™ provide "Coverage" for Long-Term Care, Assisted Living, Home Health Care, Senior Living?

Consider that a SSRPS™ can contractually help in this regard, as a SSRPS™ through the guaranteed lifetime increasing income payments can help to pay for any costs related to a potential medical crisis.

A SSRPS™ can readily provide “coverage”… in that a SSRPS™ will help pay for medical care. Furthermore, the guaranteed lifetime increasing income payments can Double (provided the accumulation value is not exhausted), if either you or your spouse (with "joint income selected") can’t perform at least two of the six Activities of Daily Living (ADLs) and or if a person is confined to a qualified hospital for at least 90 days in a consecutive 120 day period, and in all states except California, if a person is confirmed to have severe cognitive impairment.

Also, consider that even if the accumulation value is exhausted, meaning your payments cannot Double any more, your guaranteed lifetime income payments can be quite substantial, where they have increased enough over time where the guaranteed lifetime income payments you or you and your spouse are receiving could help pay for any costs related to medical care. Hopefully your guaranteed lifetime income payments will help pay a substantial portion of any cost of care… for as long as you, or you and your spouse live. Through the 1st 19 years in our example on this website, the guaranteed income “could Double” because there is still money in the accumulation value, again a requirement for the “Doubling”. After that point, you have to consider that the guaranteed income (without any Doubling) has grown to be quite substantial. For example, remembering that our hypothetical 60 year old clients put $500,000 into a "SSRPS™ annuity", through age 82 they received $1,166,575 in payments, and that year they saw their payment hit $101,642, and at age 85 it was $121,058, and at age 87 it was $136,020, and at age 92 it was $182,026.

Understand that those guaranteed lifetime income payments can be used anyway you like, meaning that if you are healthy you can spend that money traveling the world or giving it away to children and grandchildren or your favorite charities, but if you need it for medical care it is there. Keep in mind there is no medical underwriting when it comes to having a SSRPS™. Also keep in mind that no one will ever tell you “what you can and can’t do with your money”, those guaranteed lifetime income payments are your’ s to do with as you please, they will get deposited into your checking account automatically (every month or quarter or every 6 months or even annually if you like), and that’s it… So no doctor, no caregiver, no insurance company will ever tell you what you may or may not use your guaranteed lifetime income payments for…

(The Activities of Daily Living (ADLs) are daily functions most adults can perform without assistance: eating, bathing, getting dressed, toileting, transferring, and continence. To be eligible via activities of daily living, a physician must certify that you are unable to perform at least two of the six ADLs. Diagnosis must occur during the contract year prior to beginning lifetime income withdrawals or any time thereafter.)

Customer reviews

Read what our customers have to say about their experience with SSRPS™.

SSRPS software provides information that I believe they cannot get anywhere else

Thanks for the education. I believe that the SSRPS software is necessary to fully understand how a Type #2 Annuity works, which is essential to having a Safely Structured Retirement Planning Strategy. It is nearly impossible for the average person to look at an illustration on their own and understand what they are looking at, and how it might benefit them. It 100% needs to be explained by an expert and the software enhances your ability to understand what the expert is telling you. The SSRPS software provides information that I believe they cannot get anywhere else.

Danny

If you are interested in protecting and growing your assets, this is a good way to go

Mary and I have been clients of Steve’s for over eight years now. When Steve talks about his planning and respective products, he is very careful to point out a lot of what he is forecasting is exactly that; a prediction. Before you conclude he sounds just like every other investment professional our record with him is seven of eight years, reaching his targets. The insurance part of the product is perhaps a little difficult to accept. It was for us. But I’m going to make a guess that if you’re even talking to Steve, one of the things, in which you are very interested is protecting your assets. With the insurance policy someone is going to benefit which is another method of hedging your wealth. Finally, if like us, you are interested in protecting and growing your assets this is a good way to go.

Alan

This program has been wonderful for my clients

I just wanted to say that as I was researching retirement distribution planning, I ran across information on ABS and their SSRPS program and boy I’m glad I did! This program has been wonderful for my clients. The leverage that can be created to “fill retirement income gaps” is remarkable. It gives my clients the “sleep at night factor” they need to really relax and enjoy their retirement. This program improves their lives both emotionally and in stress-free physical well being. I would recommend Steve and his crew to anyone doing this type of planning.

B.W. Investment Advisor Representative / IAR

Steve has “hit the nail on the head”

I have gotten to know Steve Delaney at ABS over the last year and it has been very refreshing to get to discuss his passion for retirement income planning. As a CPA, I have found that much of the financial planning done in the financial service industry lacks the proper focus on retirement income planning and particularly Steve's niche in creating a source of guaranteed lifetime income that can grow over a client's life expectancy. I think Steve has "hit the nail on the head" of retirement income planning and is poised to make a substantially favorable impact on the advisors that utilize his program, not to mention the benefits to the clients that utilize the SSRP approach to income planning.

Laury W.

Next Big Thing!

SSRPS® is the Next Big Thing… SSRPS the Biggest Change in the industry in 20 years

Advisor M.H.

About SSRPS™ developer

Steve Delaney is a 36 year veteran of the financial services industry, a founding partner and Principal of American Brokerage Services Inc (ABS). ABS is in its 26th year, serving financial planners, Registered Representatives, Registered Investment Advisors/ Investment Advisor Representatives, and insurance agents with an Annuity, Life Settlement, Long Term Care, and a Life Insurance Division.

Steve is an advisor to the financial advisor, to attorneys, to CPA s/ accountants, to businesses, and indirectly to the consumer. Steve holds a series 65 securities license as well as an insurance license in 50 states. Steve is an Investment Advisor Representative. The Series 65 securities license is required by most U.S. states for individuals who act as investment advisors. The Series 65 exam, known formally as the Uniform Investment Adviser Law Examination, covers laws, regulations, ethics and topics such as retirement planning, portfolio management and fiduciary responsibilities. Steve graduated from LaSalle University in 1985.

Steve, with the help of his staff, is responsible for developing the SSRPS® Explanatory Software/ Platform. SSRPS®/ Safely Structured Retirement Planning Strategies® is a transparent and innovative package of retirement planning calculators, illustrators, and presentations, used by financial advisors across the country to develop “case design” with respect to retirement planning, estate planning, special needs planning, and lifestyle maintenance planning.